Our approach to responsible investment includes active ownership and collaborative enhancements to change industry behaviour.

Active Ownership

At Swiss Life Asset Managers, we consider engagement and active stewardship to be an integral part of our approach to responsible investment. We exercise our ownership rights as part of our fiduciary duty, by actively seeking to work with companies and relevant stakeholders to address ESG challenges while safeguarding the financial interests of our clients.

We systematically exercise proxy voting rights within our securities portfolio. A key element of this is analysing all voting items related to environmental or social topics such as climate change, gender equality and human rights. Additionally, we commenced systematic implementation of corporate dialogue with listed companies in 2020.

For real assets, being an active owner is of particular importance, since these investments often reveal a big leverage in shaping the investees’ behaviour.

For infrastructure investments, we always ensure that the processes, scope and content of the engagement are appropriate to the investment level. This may include full management, exercise of direct governance rights through board representation, or direct dialogue with key decision-makers. We also work closely with other shareholders and key stakeholders such as joint venture partners.

In our real estate investments, we engage with stakeholders such as tenants, suppliers, service providers and communities related to specific projects. We place particular importance on a continuous dialogue with tenants, since they use the buildings and are therefore in direct control of their operational footprint.

Collaborative Enhancement

In addition to our active ownership efforts, we promote responsible investment by providing resources and know-how to industry and sustainability associations.

We participate in governing boards and share our expertise in several working groups, including the Swiss Insurance Association and the Sustainable Investment Forum known as the FNG. Together with our active ownership efforts, this proactive involvement forms our engagement framework.

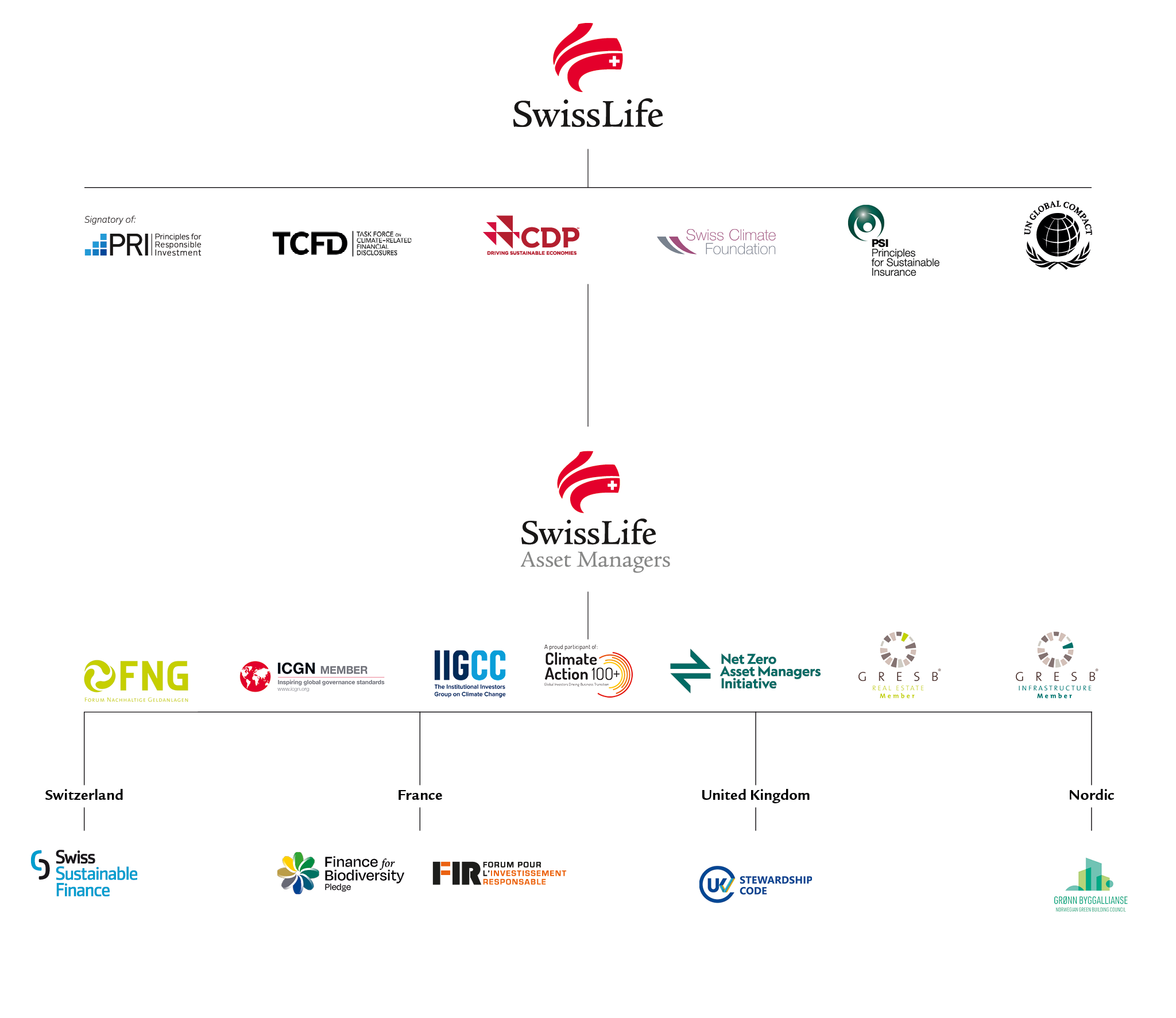

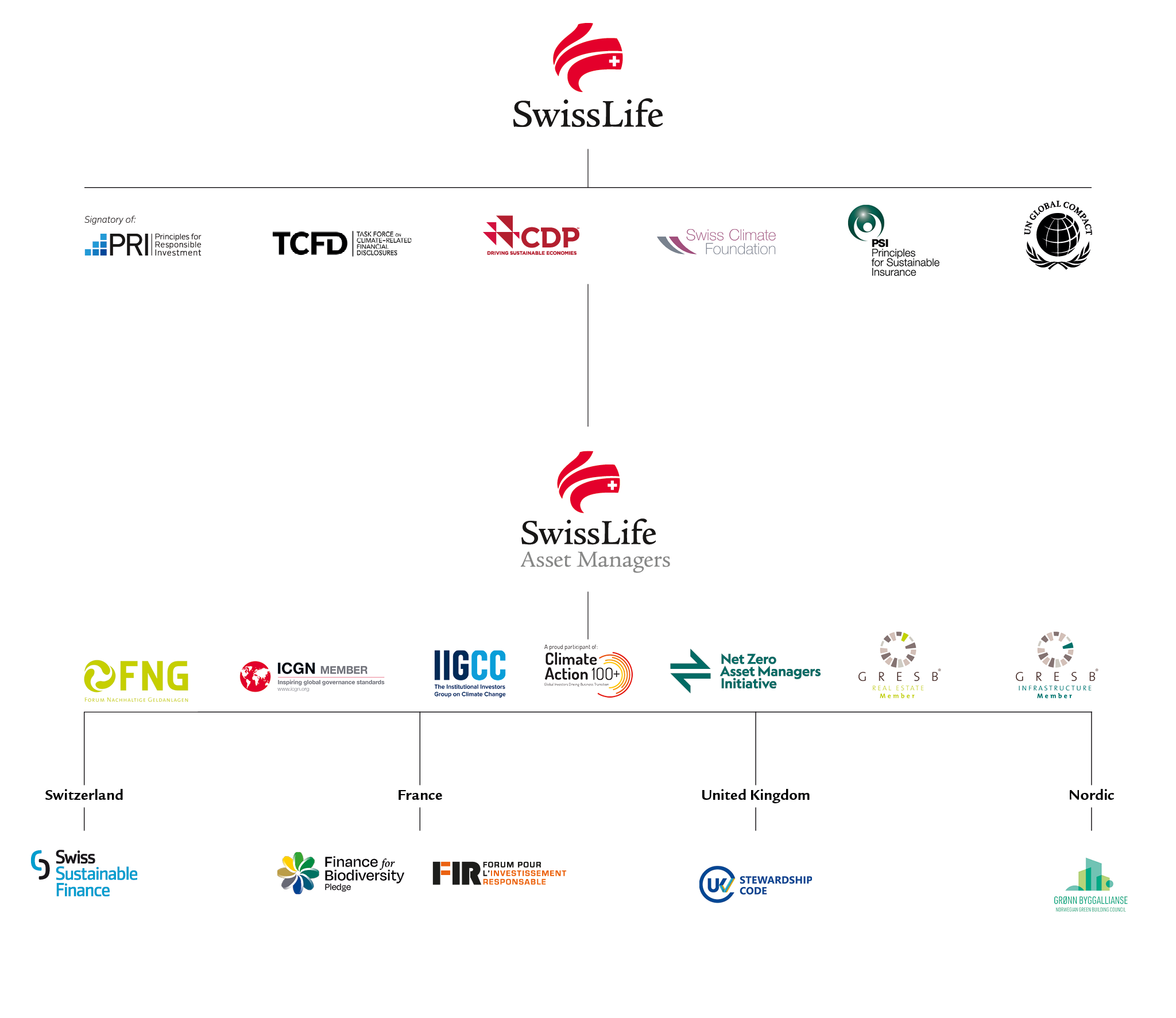

Agreements and memberships

Swiss Life Asset Managers UK are accredited as a Living Wage Employer by the Living Wage Foundation

The real Living Wage is the only UK wage rate that is voluntarily paid by almost 12,000 UK businesses who believe their staff deserve a wage which meets basic everyday needs.

Swiss Life Asset Managers UK’s Living Wage accreditation demonstrates not only a commitment to our employees, but also to those who work in our supply chain, ensuring they are paid the real Living Wage.